Announcement

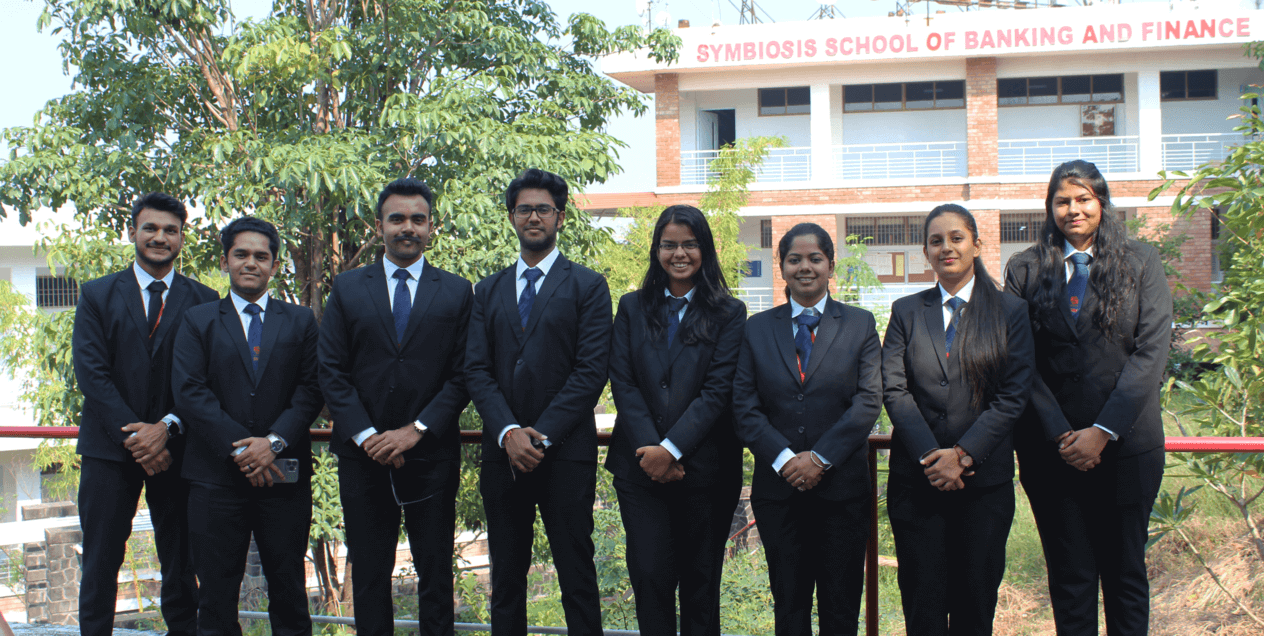

SSBF At Glance

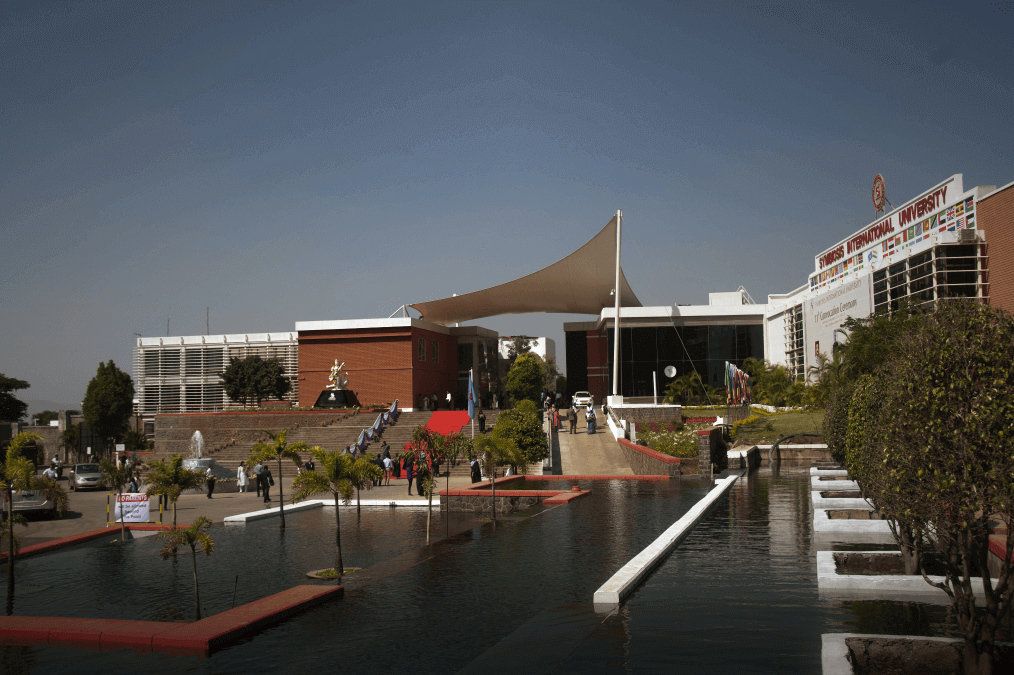

Symbiosis School of Banking & Finance (SSBF) was established to address the growing demand for trained workforce in the Banking and Financial Services Sector. Given that a strong and resilient banking system is critical for fuelling and sustaining growth, the importance of having industry-ready manpower cannot be over-emphasized. The MBA (Banking and Finance) being offered by SSBF has been designed to provide the necessary education and skill-set to equip students to innovate, manage, lead and take on the challenges of this increasingly complex and dynamic BFSI sector in the wake of constant functional and technological changes. SSBF enhances the awareness and widens the perspectives of its students placing before them the challenges facing the BFSI sector that need constant attention, study and scrutiny.

Read More

Our Programs

PG Prospectus

MBA In Banking

and Finance

The MBA (Banking and Finance) program is designed with an objective to disseminate relevant knowledge and provide skills to students such that they function effectively in the challenging environment of the Banking, Finance and Insurance (BFSI) sector. Discover excellence with SSBF's MBA in Banking and Finance, one of the best MBA in Banking in India. Elevate your career in the dynamic world of finance today.

The programme develops future BFSI leaders with requisite skills through robust curriculum and collaborative initiatives to excel in the dynamic global environment.

Read MoreNews & Events

Impeccable Placements

The Placement Cell of the SSBF has been assisting the students with arranging the campus recruitment drives for their careers.

We are proud to share that major companies from BFSI sectors, Banks, Rating companies, Investment Banking, Credit Rating, Risk Management, Retail Banking, and many more visit us for the recruitment.

These companies offer various profiles like analyst, Relationship Management, Associate Manager- Operations, Credit Manager, Financial Consultant Etc.

Our Highest Package for Batch 2021-23 is 19.69 Lacs PA and Average package is 10.56 Lacs PA.

Student Achivements

Ms. Punyatoya Priyadarshini, Batch 2022-2024, secured First Place in Solo Dance Competition – Rangmanch Rangmanch is an inter-college Annual Cultural event that was held on 17 December 2023, by the Symbiosis Institute of Digital and Telecom Management.

Ritika Deshpande (23-25 Batch) secured 2nd position in SIU Inter-Institute Chess Championship held in August 2023

.png)

Riya Kunjir , (Bacth 2023-25) received an award as a Best Female Player of the Tournament in SIU Inter-Institute Badminton Championship held in August 2023

SSBF Girls team secured 3rd position in SIU Inter-Institute Badminton Championship held in August 2023

Ashay Kumar (23-25 Batch) secured 3rd place in the 100-meter Breaststroke category in the SIU-Inter-Institute Swimming Championship held in August 2023

Campus Life

hostel

hostel

SSBF is a residential college on the Laval Hill top campus..

Medical

Medical

Team of specialist doctors who conduct the students’ annual health checkup..

dining

dining

Dining

library

library

We provided highly resourceful centralised library..

sports

sports

SSBF also provides an in-house state-of-the-art health club,..

COMPUTER / IT

COMPUTER / IT

Well organised and sufficient aeration and projector and white board equipped..

.jpg)

.jpg)

.jpg)